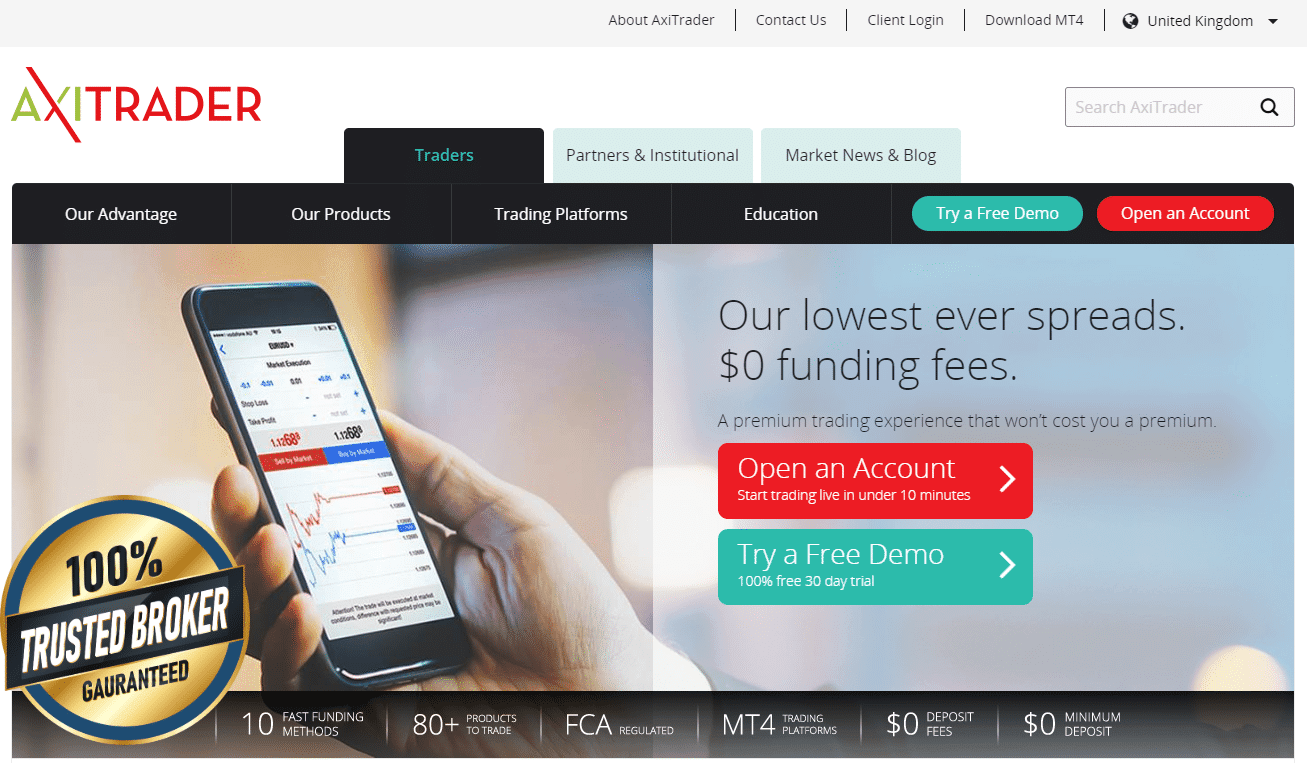

Undergoing the regulation of multiple financial authorities across the territories it operates in, it is easy to assume that trading with AxiTrader is safe.

It also costs less to trade with the firm as the Forex fees are low and it does not charge for inactivity. Withdrawals are not charged as well.

These are the things that AxiTrader has going for them. And if we are to base our assessment solely on these facets, then deciding on enlisting with the firm is easy. But of course, these are not the only elements that make up AxiTrader’s service. For this cause, the review team had spent months evaluating the following facets of the brokerage’s offerings:

- FXTM’s regulatory status

- The trading instruments that are accessible to the firm’s clients

- The trading accounts that traders may open with the firm

- The trading platforms that FXM offers

- The fees charged by the firm for its services

The review team had performed exhaustive tests on the services to come up with a pointed and detailed evaluation of FTXM’s over-all capabilities.

About AxiTrader

Formerly known as AxiTrader, Axi, an Australian Foreign Currency brokerage, was established back in 2007. In 2020, the firm had renamed itself into simply, “Axi”.

As of writing, Axi is being regulated by three international financial authorities, these are:

- The Financial Conduct Authority (FCA)

- The Australian Securities and Investments Commission (ASIC)

- The Dubai Financial Services Authority (DFSA)

These regulatory bodies are not just well-known in their respective territories, but are also top tier.

Offers and Services

AXi allows for the trade of the following assets:

Seventy-six (76) Foreign Currency pairs, 14 Stock index CFDs, 16 Commodity CFDs, and 6 Cryptos. Compared to the firm’s competitors, a number of the assets offered by Axi are marginally higher.

Available Trading Accounts

Axi offers two account types based on ownership and fee structure.

Under ownership, there are three types of accounts:

- Individual – as the name suggests, this account can be owned by only one person

- Joint – this account is meant for partnerships in trading

- Corporate – this account was created for institutions

Under fee structure, there are two types of accounts:

- Standard Account – this type of account has no commission fees and have high spreads

- Pro account – this type of account has a $7-round trip commission. In general, its spreads are low

These accounts give clients a good range of trading account options that come with advantageous features.

Offered Trading Platform

Axi does not have its own proprietary platform. In this light, it had enlisted the aid of MetaQuotes to offer the industry-leading trading platform, MetaTrader 4 (MT4).

Both MT4 are speedy in processing transactions. It also includes a number of tools and indicators.

For clients to access the MT4 platform, he or she needs to log-in first to a different client platform. The only downside to this well-designed and intuitive layout is that the MT4 platform takes a long time to load, sometimes even freezing as it loads.

MetaTrader 4 has been made available to Axi traders through a range of different languages.

Fee Structure

Axi’s trading fees are seen as competitive in light of Forex trading. These are lower compared to the fee offerings of the firm’s competitors. The sampled figures are for a $20,000 30:1 long position for a week.

EURUSD $5.1

GBPUSD $4.3

AUDUSD $3.4

EURCHF $2.9

EURGBP $5.2

Regarding the CFDs, the fees are considered at an average. The list sampled here is for a $2,000 long position for a week:

S&P 500 Index $1.3

Europe 50 Index $2.3

On the other hand, Axi does not charge for any non-trading activities. No charges are incurred for Inactivity, Deposit, and Withdrawal.

Trade with AxiTrader Today!

With everything that had been discussed, trading with Axi can be seen as completely profitable.

The trading accounts being offered have a decent range that allows for good options, being able to address and cater to the specific needs of a specific type of trader.

The trading and non-trading fees are reasonable in that the former are relatively low compared to Axi’s contemporaries while the latter are altogether absent. Admittedly, fees structures are one of the main considerations of this review and of course the traders themselves. This is why the figures presented by the firm caught the attention of the review team.

The offering of the trading platform, MetaTrader 4 is of course a wise choice. It shows that as the firm recognizes its lack of a proprietary platform (wnich is not necessarily a point against Axi), it knows that it needs to step up by offering something that traders can easily put their faith in. The only thing that needs to be improved here is the loading time to navigate through the separate client interface. This can easily be addressed and resolved by MetaQuotes and Axi’s development team as it is apparent that the offering of another interface is a collaboration betwen the two companies.

On top of all these, Axi’s legitimacy is cemented by the fact that it is being regulated by top tier financial authorities, namely the FCA, the DFSA, and the ASIC.

All these configure into the recommendation to trade with Axi.