Swing trading is a popular and effective trading strategy used by many traders to make profits in the financial markets. The aim of swing trading is to capture short-term price movements in stocks, currencies, or other financial instruments over a few days or weeks. In the book “Mastering Swing Trading: Effective Strategies for Successful Swing Trading,” traders can learn various techniques and strategies that can help them achieve success in swing trading. This book provides a comprehensive guide that covers everything from technical analysis, risk management, and trade execution, making it an essential resource for anyone interested in mastering swing trading.

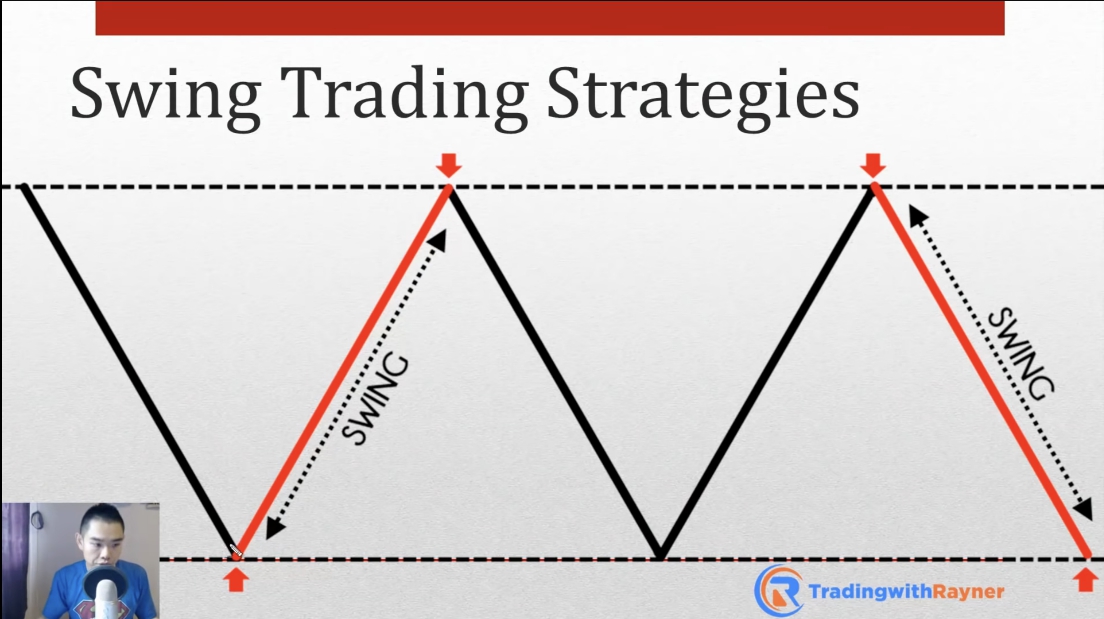

Swing trading is a popular strategy for short-term traders who want to capture price movements that occur over several days or weeks. The goal of swing trading is to identify trends and momentum in the market and profit from them using technical analysis tools.

In this article, we will discuss some effective strategies for mastering swing trading and achieving success in the markets.

1. Identify Trends

One of the most important things you need to do as a swing trader is to identify trends in the markets. This involves analyzing price charts and looking for patterns that indicate the direction of the market. You can use technical indicators such as moving averages, trend lines, and MACD to help you identify trends.

Once you have identified a trend, you can then look for opportunities to enter and exit trades based on the direction of the trend. For example, if the market is trending upwards, you may want to buy stocks or securities that are likely to perform well in that environment.

2. Use Technical Indicators

Technical indicators are tools that you can use to analyze market data and identify potential trading opportunities. There are many different types of technical indicators available, including oscillators, momentum indicators, and volume indicators.

Some popular technical indicators used by swing traders include the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands. These indicators can help you identify when to enter and exit trades based on market conditions.

3. Manage Risk

Risk management is essential for any trader, but it is especially important for swing traders who hold positions for several days or weeks. You should always have a clear understanding of your risk tolerance and set stop-loss orders to limit your losses if a trade goes against you.

You can also use position sizing techniques to manage your risk. For example, you may decide to only risk 1% of your trading account on any given trade. By doing this, you can minimize the impact of any losses on your overall trading performance.

4. Monitor News and Events

As a swing trader, you should also keep an eye on news and events that could affect the markets. This includes economic reports, earnings announcements, and other factors that could impact the price of securities.

By staying up-to-date with these developments, you can better anticipate how the market may react and adjust your trading strategies accordingly.

Why Swing Trade?

By taking a long-term perspective, you can avoid getting caught up in short-term fluctuations and make more informed decisions about your trading strategy.

In conclusion, mastering swing trading requires a combination of technical analysis skills, risk management, and a focus on the big picture. By following these strategies, you can increase your chances of success in the markets and achieve your trading goals.

Swing trading strategies can be a viable option for individuals who are looking to make profits in the stock market. This approach involves holding onto stocks for a short period of time, typically a few days to a few weeks, with the goal of capturing price movements.

Swing Trading vs. Day Trading

One advantage of swing trading is that it allows traders to take advantage of shorter-term price swings and trends, rather than having to wait for longer-term investments to pay off. However, this approach also requires careful analysis and monitoring of market trends, as well as discipline in executing trades at the right time.

Additionally, swing trading can also be more risky than other investment strategies, as the market can be unpredictable and sudden shifts in price can result in losses. As with any investment strategy, it is important to carefully assess one’s own risk tolerance and financial goals before deciding whether or not to pursue swing trading.

Overall, while swing trading can have its benefits, it is important to approach this strategy with caution and diligence in order to minimize risks and maximize potential gains.

Hello! How can I assist you today?

Maximizing Profit Potential: Effective Swing Trading Strategies for Traders

Swing trading is a popular method among traders for maximizing profit potential in the stock market. It involves holding positions for a few days to several weeks, taking advantage of short-term price fluctuations. Effective swing trading strategies require a combination of technical analysis and fundamental research to identify potential opportunities and manage risk. By using these strategies, traders can capitalize on market trends and generate significant profits while still minimizing the risks associated with longer-term investments. In this article, we will explore some effective swing trading strategies that can help traders maximize their profit potential.

Swing trading is a popular trading strategy that involves buying and selling stocks, commodities, or currencies to capture short-term price movements. The goal of swing trading is to capture profits within a few days or weeks, making it an attractive option for traders who want to maximize their profit potential without holding positions for extended periods.

To help you succeed as a swing trader, we have compiled some effective swing trading strategies that can help you maximize your profits:

1. Identify the trend: To make successful trades, it is essential to identify the trend of the market. Swing traders should look for stocks or securities that are in an uptrend, with higher highs and higher lows, or downtrend, with lower lows and lower highs. Once you identify the trend, you can enter into trades that align with it and increase your chances of success.

2. Use technical analysis: Technical analysis involves analyzing charts and patterns to identify potential trading opportunities. As a swing trader, you should pay attention to key indicators such as moving averages, support and resistance levels, and candlestick patterns. Using technical analysis can help you make informed decisions about when to enter and exit trades.

3. Develop a trading plan: A trading plan is essential for every trader, especially those engaged in swing trading. Your trading plan should include your goals, risk management strategies, entry and exit points, and stop-loss orders. A well-defined plan can help you avoid impulsive decisions and stick to your strategy even during volatile market conditions.

4. Manage risk: Risk management is critical in swing trading, where positions are held for a short period. You should decide how much you are willing to risk on each trade and set stop-loss orders to limit your losses. Additionally, you should avoid overtrading and stick to your trading plan.

5. Keep up with news and events: Swing traders should stay updated on news and events that could affect the markets they trade in. News releases, earnings reports, and economic data can all impact prices and create opportunities for swing traders. By being aware of these events, you can adjust your strategy accordingly and maximize your profits.

6. Be patient: Successful swing traders are patient and disciplined. It takes time to identify potential trading opportunities and wait for the right entry and exit points. Don’t rush into trades and avoid FOMO (fear of missing out) mentality.

In conclusion, swing trading can be a profitable strategy for traders who want to maximize their profit potential. By following these effective swing trading strategies, you can increase your chances of success in the markets. However, remember that no strategy guarantees success, and there is always a risk involved in trading. Therefore, it is crucial to manage your risk carefully and stick to your trading plan.

Swing trading strategies can be a viable option for traders looking to capitalize on short-term price movements in the market. This approach involves holding positions for several days to several weeks, with the goal of profiting from market fluctuations.

One advantage of swing trading is that it allows traders to take advantage of both bullish and bearish trends, as they are able to go long or short depending on their analysis of the market. Additionally, swing trading requires less time and attention than day trading or scalping, as positions are held for longer periods.

That being said, swing trading does carry some risk. Volatility in the market can quickly turn against a trader’s position, resulting in losses. It is important for traders to have a solid understanding of technical analysis and risk management strategies in order to succeed in swing trading.

Overall, swing trading can be an effective strategy for experienced traders who are willing to put in the time and effort to analyze the market and manage risk appropriately. As with any trading strategy, it is important to do your research and understand the risks involved before committing to a trade.