Exness was established in 2008 by a group of Finance and I.T. professionals with a common purpose of providing high-quality trading services. This broker grew rapidly in recent years in light of its systematically improved trading conditions, which are the core of its services. As of the end of 2019, Exness’ monthly trading volume hit $325.8 billion from 72,721 clients all around the world. This broker has consistently topped monthly trading volumes in recent years.

Exness Regulation and Security

Nymstar Limited, which operates under the Exness brand and trademarks, is a Securities Dealer registered and licensed in Seychelles. It is authorized and regulated by the Financial Services Authority in Seychelles or FSA. The FSA is a well-respected entity in the financial markets and operating under its jurisdiction is commonly taken as a good indication that the broker is reliable. Nymstar Limited provides services under Exness to jurisdictions outside the European Economic Area.

Aside from the FSA, Exness holds regulatory papers from two other independent authorities. Exness (Cy) operates in Cyprus under the regulatory terms and conditions of the Cyprus Securities and Exchange Commission or CySEC. Lastly, Exness (UK) Ltd is an investment firm authorized and regulated by the Financial Conduct Authority in the United Kingdom with license no. 730729. This license allows Exness to operate in the jurisdiction of Great Britain.

Exness also released a Risk Disclosure that states the risks and dangers associated with trading activities on financial markets. It warns traders against the probability of losing money on trades, which they must be fully aware of before trading. Some of the risks listed by Exness are the use of leverage, the instability of the markets, technical and market risks, and force majeure events.

Exness Account Types

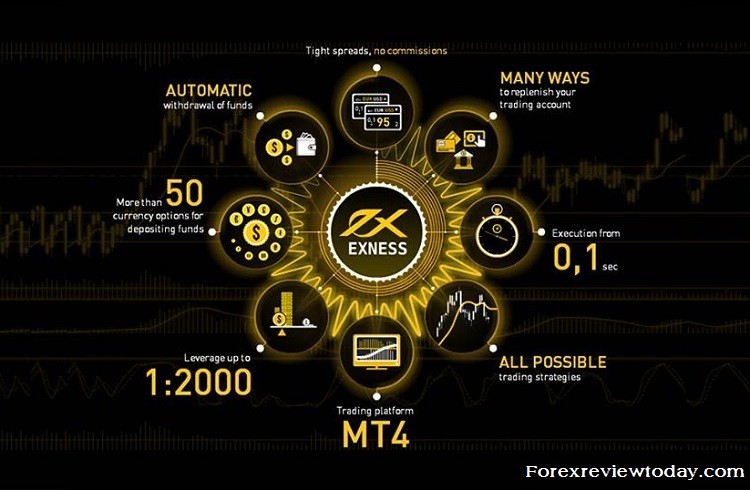

Exness offers two main types of accounts: Standard and Professional. Under the Standard Account, Exness offers Standard and Standard Cent. Raw Spread, Zero, and Pro fall under the professional accounts.

To begin trading with Exness, you only need to follow a few simple steps.

- Register on the broker’s website, providing all the necessary information about yourself.

- Verify the personal details you provided. Once you complete the verification process, proceed to the next step.

- Now you can deposit funds to your accounts. To deposit, you may choose one of the following methods: Online Bank Transfer, Debit/Credit Card, Bitcoin, USDT, SticPay, AstroPay, Neteller, Skrill, Perfect Money, WebMoney, and Internal Transfer. The same methods are used in withdrawal processes. All transactions are done instantly and hassle-free.

- Once you have deposited the needed funds, you can then proceed to the fourth step: open your desktop, web, or mobile platform and begin trading.

Standard Accounts

The Standard Accounts both require a minimum deposit of $1. For MT4 users, the leverage is 1:Unlimited leverage, while for MT5 users it’s 1:2000. Spreads begin at 0.3 pips without any trading commissions. The only difference is that the Standard Cent account is mostly recommended for novice traders so they can learn trading with micro-lots, while the other Standard account is for any type of trader.

Professional Accounts

Similar to the two Standard Accounts, the MT4 users with Professional Accounts are entitled to a leverage of 1:Unlimited, while MT5 traders use 1:2000. The Raw Spread, Zero, and Pro accounts all require a minimum deposit of $200. Zero and Raw Spread accounts benefit from low spreads that begin at 0.0 pip, while the spreads for the Pro account starts at 0.1 pip without any trading fees charged. On the other hand, Raw Spread charges $3.5 maximum fee per lot per transaction and Zero charges $3.5 minimum fee per lot per trade.

Exness Tools and Analysis

Exness offers several tools that can be used in forex analysis and actual trading. This broker ensures that its clients have all the essential materials for a comfortable and profitable trading. Below are some of the tools provided by Exness:

Trader’s Calculator

You can use the calculator to compute the required margin for a specific trade you are looking to execute, the risk/reward ratio of an existing position, and the pip value of a particular currency pair.

Economic Calendar

This tool keeps track of all market events, from the smallest price movements to the macroeconomic financial affairs. It lets traders check the price movement of a specific asset at a particular time, allowing them to foresee the probable direction of its price.

WebTV

The WebTV service partners with Trading Central in providing a live stream of market news coverage direct from the New York Stock Exchange. This ensures that traders are updated with the latest financial news.

Exness Review Conclusion

Exness is one of the leading brokerage firms in the market. It commonly tops the list of brokerage firms with the highest monthly trading volume, hitting a record figure in December of 2019. In the beginning of 2020, Exness was again in the news for hitting another record monthly trading volume. These kinds of news support the conclusion that Exness is highly-trusted by its clients in all areas of services and security standards.