Tickmill was established in 2014 and continued expanding its services as it is now regulated in multiple jurisdictions. Tickmill is known as a CFD broker to over 100,000 traders worldwide. It offers over 80 financial instruments alongside ultra-fast trade execution and support to all trading strategies.

Know how Tickmill can be of service to you by discovering its features, conditions, and offerings in this detailed broker review.

Tickmill Background & Safety

Tickmill is operated and owned by the Tickmill Group of companies. Tickmill Group is comprised of Tickmill UK Ltd, Tickmill Europe Ltd, Tickmill South Africa, Tickmill Ltd, and Tickmill Asia Ltd.

Tickmill’s group of companies is regulated in some of the world’s most reputable financial institutions. The Financial Conduct Authority (FCA) regulates Tickmill UK Ltd. Tickmill Europe Ltd is full compliance with the regulations of the Cyprus Securities and Exchange Commission (CySEC). The Financial Sector Conduct Authority is the one regulating Tickmill South Africa. Tickmill Ltd is regulated by the Financial Services Authority of Seychelles while Tickmill Asia is under the regulatory supervision of the Financial Services Authority of Labuan Malaysia.

By the numbers, Tickmill displays its might as it has 166,000 clients with 350,000 registered accounts. These huge numbers of traders account for Tickmill’s 273 million executed trades while its team of customer support continues to grow above 150 which is scattered across continents.

Tickmill asserts its advantageous offerings as a CFD broker providing tight spreads and low commission fees, market-leading execution speed, support to all trading strategies, advanced trading technology, and a multilingual team of professionals.

It is also no secret that Tickmill is an award-winning trading brand as it won numerous accolades from the year 2017 to present from different award-giving bodies in the financial industry. To name a few, Tickmill nabbed Most Trusted Broker in Europe in 2017 by Global Brands Magazine, Best Forex CFD Broker 2018 by Jordan Forex Expo Awards, Most Transparent Broker 2019 by Forex Awards, and Best Trading Experience by Forex Brokers Award 2020.

Tickmill Features & Fees

Financial Instruments

Tickmill offers an array of financial instruments including forex (with 60 currency pairs available), stock indices and oil, precious metals (Gold and Silver), and bonds (German bonds).

Account Types

Tickmill parades three account types for its clients to choose from: Pro Account, Classic Account, and VIP Account.

Let’s take a close look at the set of trading conditions under each account type.

Pro Account – a $100 minimum initial deposit is all you need to access this account type which provides you with spreads starting from 0.0 pips, and leverage of up to 1:500. The commission fee in trading using this account is $2 per side per 100,000 worth of trade volume. This account supports all trading strategies and is convertible to a swap-free account.

Classic Account – also with a minimum deposit worth $100, you can access spreads starting from 1.6 pips, 1:500 maximum leverage, and zero commission fees. Just like Pro Account, Classic Account is convertible to a swap-free account and supports all trading strategies.

VIP Account – with a minimum initial deposit amounting to a whopping $50,000, you can trade under this account type with the following trading conditions: access to spreads starting from 0.0 pips, leverage of up to 1:500, a commission fee of $1 per side for every 100,000 trade volume, swap-free account conversion, and support to all trading strategies.

Tickmill also sports a Demo account for traders to have a trading field to test their trading strategies without any financial risks.

Funding Methods

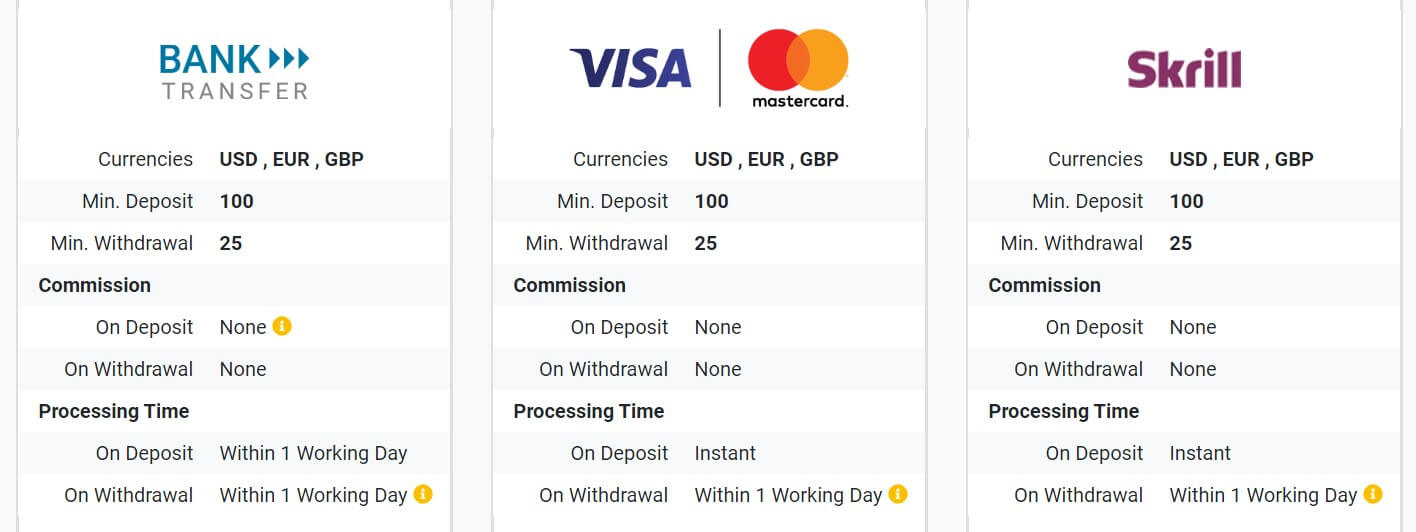

Tickmill provides several methods to fund your trading account. Depending on your jurisdiction, some options are not available for you. These are the broker’s supported payment modes: Bank Transfer, Visa, Skrill, Neteller, Sticpay, Fasapay, UnionPay, NganLuong.vn, Qiwi, and WebMoney.

For withdrawal transactions, the same methods are available and accessible based on your jurisdiction.

Tickmill does not charge clients with any transfer fees for depositing and withdrawing funds. Intermediary banks or e-wallets, however, may charge clients with a certain processing fee.

Promotions

Tickmill offers the $30 Welcome Account for new clients to trade free trading funds without having to make any deposit. Interestingly, as you open a live account in Tickmill, you may have the chance to win a $1,000 incentive if you become the Best Trader of the Month.

Tickmill Trading Platforms & Tools

Tickmill utilizes the industry popular MetaTrader 4 as its main trading platform offering. Here are the salient features of MT4: huge depth of liquidity, Expert Advisors trading facilities with VPS services, over 50 indicator tools and customizable charting available in 39 languages, and trading signals with an advanced notification system.

Tickmill’s MT4 comes in many versions including Windows, MacOS, Android, iOS, and WebTrader.

Tickmill’s MT4 WebTrader is another option for traders who do not want to download and install programs or a mobile app. WebTrader has almost the same features as the other versions of MT4 save for a lower the number of indicators available in this version.

Bottom Line

Tickmill is worth trying as it offers a $30 Welcome Account to new traders who want to trade without depositing funds. This is a good complement to the broker’s tight spreads offering and low commission fees.