Tooled with more than enough trading instruments across several asset classes, a lightning-fast trading execution, low spreads, and industry-popular trading platforms, IronFX is not too far from the long list of decent brokers that you can choose from.

In this broker review, we’ll lay down IronFX’s trading features, special offerings, and advantageous trading conditions. We will also rundown the broker’s fair share of limitations to help you weigh your options before you make your IronFX login. But before we dive into the full analysis of the broker, let us first take on the advantages and disadvantages of trading with IronFX.

Advantages:

- Transparent pricing

- Advanced trading tools

- Easy-to-navigate trading site

Disadvantages:

- Outdated research tools

- No proprietary platform

- Lack of offered financial instruments

Read this comprehensive broker review to learn more about IronFX’s specifics and other key features.

IronFX History & Security

IronFX is an established brand in the brokerage scene, serving 1.2 million retail clients from nearly two hundred countries and providing 24/5 support in more than thirty languages. Headquartered in Bermuda, IronFX started servicing online traders since 2010. The broker is known for its dedication to protecting its clients’ investments.

When it comes to fund safety, IronFX is also at the forefront as its client funds are kept separate from company funds, ensuring that the clients’ funds will not be used in case of insolvency.

It is also important to note that some IronFX account types have direct interbank trading access, while, unfortunately, the broker also uses a counterparty dealing desk. In essence, conflict of interest is a pressing concern that traders need to consider. Also, the broker does not offer guaranteed stop-losses. But traders can be safe from going beyond zero balance as it does provide negative balance protection in accordance with ESMA regulations.

Lastly, proving its brokerage service as top-tier, IronFX is a recipient of more than forty international investing awards.

IronFX Fees & Features

Accounts & Spreads

Trading the major currency pair (EUR/USD), traders have access to spreads starting from 0.7 pips. Using the Micro and the VIP accounts, spreads for major currency spreads are ultra-tight. Traders trading the minor pairs, though, do not benefit from using any of the abovementioned accounts as the spreads remain unchanged. Additionally, tiers are applicable only to forex, with all account forms paying comparable spreads and/or fees while trading CFDs or spot instruments. Numerous pages that are not properly connected to the main site advertise the availability of cryptocurrency trading, but our reviewer discovered no detail about contracts, spreads, or fees.

Aside from forex fees, IronFX also charges non-forex fees to its clients. Trading accounts that remained inactive for twelve months are charged with a $50 fee. Additionally, the broker, according to its policies, has the right to fine 3% from the client’s deposited assets for an indefinite period of time during the inactivity period.

Promotions and Bonuses

This aspect is one of IronFX’s strengths as a broker as it has a good set of perks for its clients. New traders are gifted with a 20% to 100% welcome bonus, depending on the initial deposit amount.

Note, though, that the deposit bonus is not cash convertible, meaning, you can’t withdraw them. The deposit bonus is added to your trading account balance, which you can use for trading. This particular offering varies from one jurisdiction to another.

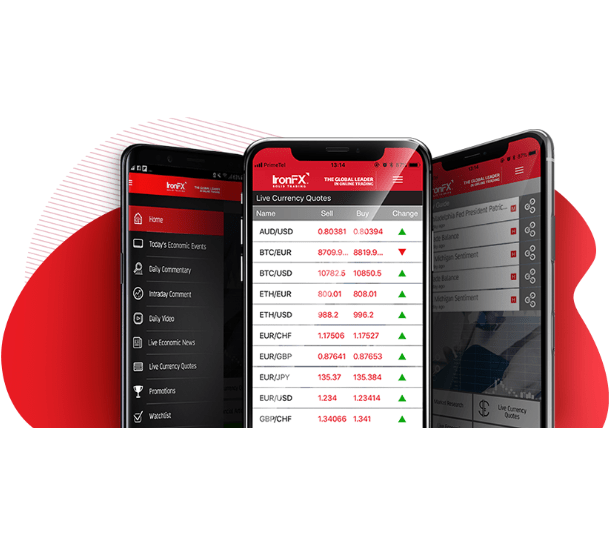

IronFX Trading Platforms & Tools

Along with the majority of brokers, IronFX utilizes the industry-known MetaTrader platforms. Unfortunately, the broker has yet to develop its own platform to provide its traders with a whole new level of trading experience. Since the broker does not utilize a third-party service, social and copy trading features are limited.

If you are a trader who is inclined to using hedging as a trading strategy, the broker’s Micro account does the job more than what some think as a social trading guide. Though MT4 and MT5 are the most popular platforms, skilled traders would normally look for more advanced trading platforms to maximize their trading activities and chances. Using the MetaTraders at the least would ensure reliability and extensive capabilities for any trader.

Verdict

Overall, IronFX remains to be a go-to site among traders especially that the broker offers competitive pricing, different types of forex accounts, and enough cushion to fend off trade risks.

On the flip side, IronFX cannot be set apart from the rest of ordinary brokers since it does not provide a more advanced trading platform to its users. Developing and introducing a new platform will provide a big boost to its campaign to be in the upper echelon of brokerage services.