Known as Australia’s first MT4 forex provider, GO Markets is a forex and CFD broker offering margin forex, commodities, indices, share CFDs, and cryptocurrencies. It is a MetaTrader-only broker.

Know more about GO Markets and its advantages and offerings by gleaning through this broker review.

GO Markets Background & Safety

GO Markets Ltd is an international trading brand headquartered in Australia and has offices in Saint Vincent and the Grenadines, Cyprus, Dubai, Taiwan, London, and Hong Kong. It strives to be the first choice of novice and veteran traders when it comes to CFD trading by providing reliable customer support, transparent pricing, low-latency trade execution, and dependable trading platforms.

Living up true to its mission, GO Markets was rated No.1 for customer service by the Investment Trends December 2019 Australia Leverage Trading Report. Its educational programs were also recognized with the Highest Satisfaction award.

Some of the advantages that GO Markets proudly claims to have are low spreads (starting from 0.0 pips), fast execution (low latency environment), excellent 24/5 multilingual customer support, a wide range of tradable CFD products, no deposit fees, multi-assets trading accounts, and dependable trading platforms.

Since its foundation in 2008, GO Markets is regulated and supervised by the Australian Securities and Investment Commission (ASIC), one of the major regulatory institutions worldwide. In terms of clients’ fund safety, GO Markets segregated all its clients’ funds through client trusts accounts at top-tier banks in National Australia Bank and Commonwealth Bank.

GO Markets services are not available in some jurisdictions including the USA, Japan, Egypt, Pakistan, New Zealand, Israel, Belgium, Canada, Ontario, Quebec, and Ukraine.

GO Markets Features & Fees

Financial Instruments

GO Markets has over 350 trading instruments from forex (over 50 currency pairs), share CFDs (280 CFDs), indices, metals, and commodities.

Account Types

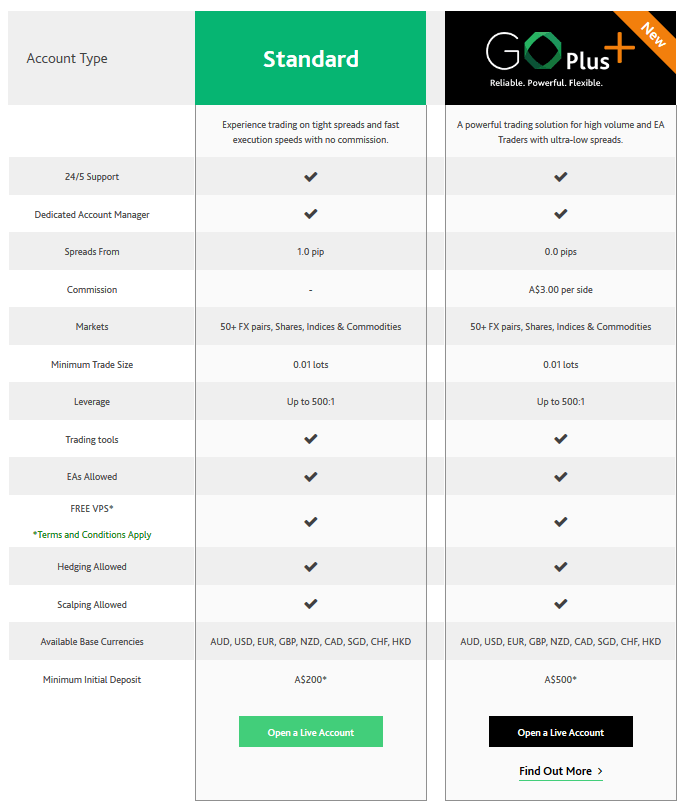

As seen above, the broker offers two trading accounts: Standard and GO Plus. For a $200 minimum initial deposit, you can sign up for the Standard account that provides you with a dedicated account manager, spreads from 1.0 pips, no commission, access to all financial markets, 500:1 maximum leverage level, and 0.01 lots minimum trade size.

The GO Plus account requires a $500 initial deposit amount to leverage for a dedicated account manager, spreads starting from 0.0 pips, $2.50 per side commission fees, access to all financial markets, 0.01 lots minimum trade size, and 500:1 maximum leverage.

Both accounts are optimized by trading tools, Expert Advisors, free VPS service, and trading strategies including scalping and hedging. The main advantage of using GO Plus is its free access to MT4 Genesis and Autochartist.

The broker also offers Demo Account for traders who want to test their strategies for a 30-day free trial. The broker does not have a swap-free account for Islam traders.

Funding Methods

For safe and convenient deposit and withdrawal transactions, GO Markets clients can access the Client Portal. Some of the payment methods facilitated by the broker include VISA, Mastercard, Skrill, BPAY, Poli, Bank transfer, Fasapay, and Neteller.

The broker does not charge withdrawal fees. However, fund withdrawals to non-Australian banks may be subject to bank fees from any intermediary bank involved in the transaction. The client’s bank may also charge a receiving fee.

GO Markets Trading Platforms & Tools

GO Markets offers the industry-standard platform in MT4. The broker’s MT4 offering comes with the desktop version, mobile version, and Web Terminal version. On its official site, Go Markets marked the launching of MetaTrader 5 as an additional platform offering.

Despite only having the industry-standard platform offering, GO Market’s MT4 platform is not just the standard as it is equipped with a range of tools, with MT4 Genesis as its most salient feature.

Some other features of GO Market’s MT4 include access to more than 350 trading instruments, Expert Advisors, and built-in indicators. The MT4 platform is available in several downloadable versions including MT4 for Windows, MT4 for Mac OS, MT4 for Android, and MT4 for iOS.

The broker offers some educational resources including MetaTrader 4 user guide, MetaTrader 4 video tutorials, and MetaTrader 4 demo account.

GO Market’s WebTrader is the web-based MT4 version for instant access to the platform.

GO Markets has an established educational infrastructure for trading through its Education Centre which consists of GO Trade Academy, Forex Education Courses, Forex Trading, Introduction to Forex, and Tutorials.

Bottom Line

GO Markets is a considerable broker as some aspects of its trading services are a notch higher compared to other ordinary brokers in terms of regulatory credential, trading fees, trading instruments, MT4 offering, and customer support.

A negative balance protection policy would be a good addition to the broker’s asset to attract more investors and traders.