GKFX is a brokerage service provider that focuses on the forex market with a solid, modern ECN platform for its clients. It also takes pride in providing high-quality trading execution and tight spread offerings. The broker also puts emphasis on price transparency and welcomes beginning traders with zero minimum initial deposit for opening an account.

Learn how you can maximize your trading opportunities with GKFX as a legit forex broker. Read more to discover more reasons to try GKFX.

GKFX Background and Safety

Established in 2009, GKFX joined the financial markets service industry led by a group of individuals who had decades of experience in the financial sector. GKFX’s parent company is headquartered in London, U.K.

GKFX aims to provide a transparent service by ensuring that there is no conflict of interest between the company and its clients. The broker is also committed to providing unrestricted trading by allowing all types of trading strategies preferred by the trader. Limit orders are also accessible to the clients as well as market depth.

GKFX also thrives in providing its traders high-quality trading execution by avoiding delays or requotes of prices. It offers tight spreads that come along with their MetaTrader platforms. More notably, GKFX has micro lots available and zero minimum initial deposit for new traders plus a free demo account to test how trading works with its system.

As of today, GKFX offers its services in 17 different countries worldwide. The GKFX main office in London is registered and supervised by the Financial Conduct Authority (FCA). It is interesting to note, though, that its services are only within the Asian and European regions. In all the countries it serves, GKFX secured all licenses from regulatory bodies of its jurisdiction. Having this said, GKFX is a safe broker and practices honest trading services.

GKFX Features and Fees

Markets/Financial Instruments

GKFX offers forex (40 currency pairs), (spot) metals, Oil, and CFD Index as trading instruments. Its subsidiaries, however, have a wider array of financial instruments in their services. Approximately, the global brand offers over 600 assets across five classes.

Account Types

GKFX features three account types for its traders to choose from: the STP.MT4 account, the ECN.MT4 account, and the PRO.ECN.MT4 account.

The STP and ECN accounts share some commonalities in terms of trading conditions. One of these is the zero minimum initial deposit. Another similar condition is the trading volume in which the minimum is set at 0.01 lot while the maximum trade volume is at 100 lots.

If we look at the common trading terms set for the three account types, traders using any of the account types can enjoy an unlimited quantity of orders, market spreads starting at o pips, and leverage of up to 1:500.

More so, a locked margin for forex trading is at 50% while the Stop Out rate is at 60% for the three accounts. The featured trading platforms for each account are the different versions of MetaTrader 4. Lastly, all the offered accounts feature scalping and the Expert Advisor (EA) functionality.

There is also a set of trading conditions that is unique to each trading account. For the PRO.ECN account, there is a required initial deposit set at $10,000. It also entails a commission fee of $15. The STP account has no commission fees and employs instant execution during live trading. However, there are requotes and no market depth accessibility in this account.

Lastly, the ECN account has a $25 commission fee and employs market execution during live trading.

Funding Methods

The most popular replenishment and withdrawal methods for trading accounts are available in GKFX. In particular, the broker offers Bitcoin, Visa, MasterCard, Web Money, Qiwi Wallet, Neteller, Skrill, and bank transfers.

There are features and limitations for each funding method chosen by the account user which can be seen through its official site.

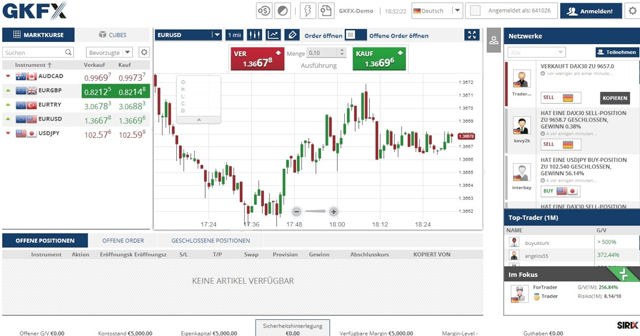

GKFX Trading Platforms and Tools

GKFX empowers its traders by offering the full suite of the MetaTrader 4 platform. This is comprised of the web version, the downloadable version, and the mobile version.

The platform offering is equipped with all the basic analytics tools and back-testing functionality. Some of the key features of the MT4 include trading on both demo and live trading account; an array of options of indicator tools, expert advisors, and scripts; trailing stops, customizable indicators and other features; automated trading; online economic news; and secure encryption.

For mobile trading, GKFX offers the MetaTrader 4 for iPhone devices. This version is powered by advanced trading features including real-time quotes, full range of orders, complete trading history, interactive quote charts, and customizable technical indicators.

Bottom Line

Being a global broker, GKFX is positioned to cater to Asian and European traders and offers easy account opening with no minimum deposit. Offering high leverages is one of the nice-to-haves for the broker to lure more traders to complement its powerful ECN account.