An Australian-based site, Fusion Markets is a brokerage firm that offers forex, CFDs, and cryptocurrency trading using the MetaTrader 4 platform. With no minimum account size, multi-regulated Fusion Markets is ready to accept traders of all backgrounds.

Know more about the best trading conditions offered by Fusion Markets as well as its features, services, and trading tools by reading this broker review.

Fusion Markets Background & Safety

Gleneagle Asset Management Limited is the company behind the Fusion Market brand in the brokerage industry that started servicing in 2010. Fusion Markets came with a mission to provide low-cost, world-class technology, and friendly support among traders.

Gleneagle Asset Management Limited holds an Australian Financial Services License (AFSL) and is regulated by the Australian Securities and Investment Commission (ASIC). The other entity, Gleneagle Securities Pty Limited is a registered Vanuatu company and is regulated by the Vanuatu Financial Services Commission (VFSC).

Being duly regulated, Fusion Markets deposits all its client monies into segregated Client Trust Accounts with Westpac, Australia’s first bank that provides a broad range of consumer, business and institutional banking and wealth management services through a portfolio of financial services brands and businesses.

Fusion Markets boasts its distinct advantages as a broker – being Australia’s Lowest Advertised Forex Commissions, having white glove support, no deposit fees, offering flexible leverages, and no minimum account size – all these with the MetaTrader platform, Fusion Markets is a safe bet among traders.

Fusion Markets Features & Fees

Market Coverage

Fusion Markets provides its traders with access to a basketful of assets covering forex (90+ currency pairs), energy (Crude Oil, Brent Oil, and Natural Gas), precious metals (Gold, Silver, Zinc, Copper, Platinum, etc), equity indices, commodities, and share CFDs.

Account Types

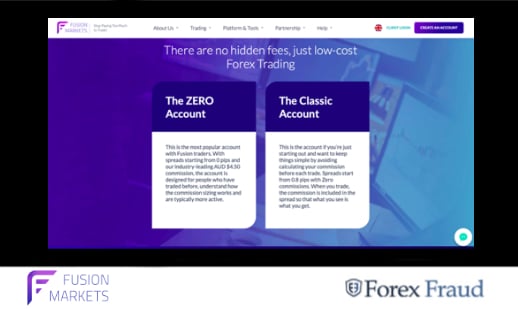

Fusion Markets offers two account types: The ZERO Account and The Classic Account.

The ZERO Account is for active traders who are adept in commission sizing in trading. Spreads in this account type start from 0 pips and its commission fee is AUD$4.50.

The Classic Account has no commissions as they are already included in the spreads that start from 0.8 pips. This account type is ideal for novice traders.

The broker also offers a corporate account for institutional traders. A free demo account version is also available for traders who want to try trading with no financial risks.

With no minimum account deposit, traders are free to open any of the two trading accounts. However, they still need to fund their accounts in order to start trading. The broker does not also charge any inactivity fees for inactive traders.

Account Opening

Opening an account with Fusion Markets is easy and fully digital. Follow these easy steps to open your preferred trading account:

(1) Indicate your email and create a password; (2) log in to the Client Portal and click Profile; (3) modify your profile by indicating your personal information including date of birth, country of residency, etc.; (4) choose your account type to open, set your preferred leverage level, and provide a security question, and; (5) send your personal documents such as ID or passport to verify your identity.

Funding Methods

Another plus factor of trading with Fusion Markets is its client-centric service, waiving its deposit and withdrawal fees. It also accepts and facilitates payment using popular payment methods including credit/debit cards, bank transfers, and online payment systems such as Neteller, Skrill, and Perfect Money.

When transacting through bank cards, withdrawal amounts must not be more than the deposited amounts.

Fusion Markets Trading Platforms & Tools

Fusion Markets offers the industry-popular MetaTrader platform.

Its web version is highly customizable and provides a clear fee report. However, the platform interface is less than ideal and needs upgrading.

Meanwhile, the desktop version has price alerts but displays the same design as the web version. Its features are also similar to the web version having the same order types, search functions, and fee reports.

Fusion Markets also enabled mobile trading by offering a mobile app of MetaTrader 4. This platform is compatible with Android and iOS devices.

Aside from MetaTrader 4, the broker has nothing else to offer. This could be something that Fusion Markets has to do something about in order to keep up with the leading brokers fielding award-winning platforms. A proprietary platform would be a good addition to the broker.

Other useful trading tools Fusion Market offers include Multi Account Manager, Virtual Private Server, Myfxbook AutoTrade, and DupliTrade.

Bottom Line

Fusion Markets is a top Australian broker as it provides market-leading commission schemes and no minimum account deposits. Boosting its trading servicers, Fusion Markets can turn its market coverage into a comprehensive one, offering more financial instruments, as well as offering a proprietary trading platform.