Ayondo is a financial trading technologies company in Germany founded in 2009. Being a multi-award-winning Forex, CFD, and Binary Options broker, Ayondo provides a cutting-edge social trading platform to go along with its proprietary trading platform.

Learn more about Ayondo’s services and our review of its significant brokerage aspects.

Ayondo Background & Safety

Originators of the Ayondo brokerage firm introduced the brand in 2009. It was first established in Germany, but the broker eventually amassed a huge following among traders, making it a global broker. Ayondo moved its headquarters to London.

Ayondo introduced their own brokers solution in 2013, which is a white-labeled version of the Gekko Global Markets platform. In 2017, Ayondo launched its investor education application TradeHero and became the first FinTech enterprise to be listed on Singapore’s Stock Exchange. Reports have it that Ayondo makes more than £10 million annual revenue.

As the number of fraudulent and scam brokers continues to rise, it is important to look into the legal or regulatory aspect of the broker you are eyeing to sign up with to know if you are investing in a safe broker. On the bright side, Ayondo is a regulated broker as it is certified by the Financial Conduct Authority (FCA). Being one of the major regulatory bodies in the world, FCA ensures that its members are complying with the highest standards of keeping client funds secure and is held in a segregated account.

Ayondo accepts traders from Australia, Thailand, United Kingdom, South Africa, Singapore, Hong Kong, India, France, Germany, Norway, Sweden, Italy, Denmark, United Arab Emirates, Saudi Arabia, Luxembourg, Qatar, and several other countries. Unfortunately, traders residing in the United States and Canada are restricted from accessing Ayondo’s services.

Ayondo Features & Fees

Market Coverage

The broker offers a wide selection of tradable assets including CFDs, precious metals, interest/bond rates, more than 30 currency pairs, major Asian, European and US indices, shares in major blue-chip companies, including Starbucks and Coca-Cola, and cryptocurrencies.

Account Types

There is not much to look into when it comes to the account types of Ayondo. It only offers one live account. Thankfully, it also offers a demo account to help users practice their trade strategies and familiarize themselves with the features and trading environment of Ayondo.

The live account features the Standard account. To open the Standard account, you just need to deposit as low as £1 – a good catch for beginning traders and those who prefer a small trading capital. You can open the live account in Euros, GBP, and USD.

Having a social trading platform, Ayondo offers a special account for copy traders. It is a Social account. Account users should practically maintain an account balance of 500 to 1000 Euros. A Swap-free account is also available with the broker.

Being regulated by the FCA, Ayondo holds a meticulous screening process for its traders. You need to pass a few basic compliance checks to ensure that you understand the risks of trading. Also, part of the process is asking you a few questions to determine the level of trading experience you possess before opening your account.

Moving forward, note, though, that there are different trading levels you will pass through. Each level has a set of trading benefits for your consumption. Essentially, if you deposit more than £500 in your account, you will receive a Money Trader’s Badge.

Trading Fees

Looking at the trade costs, the spread for EUR/USD starts at 0.8 pips. The GBPUSD spread starts at 1.1 pips. Ayondo’s rollover costs are only 50% of standard spread costs. Traders outside the U.K. and E.U are offered up to 200:1 leverage.

Using its social trading platform, up to a 25% performance fee, plus a 1% management fee are charged among users.

No inactivity fee is charged by the broker among inactive users.

Funding Methods

One of the aspects that Ayondo needs to work on is its payment options. Ayondo only accepts payments via credit/debit cards and wire transfers.

There is no deposit fee for credit/debit card depositors unless your credit or debit card was issued outside the European Economic Area, in which case there is a 1.75% deposit fee. Withdrawals can be made using the same deposit method. However, processing takes up to five business days.

Ayondo Trading Platforms & Tools

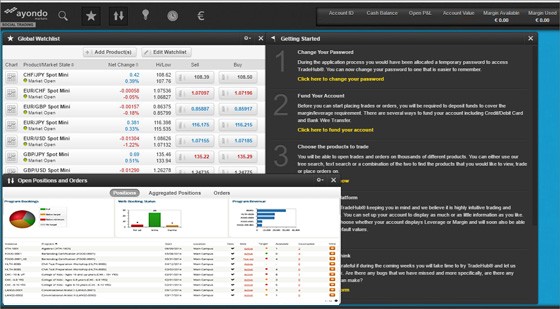

Ayondo Market’s TradeHub live platform is totally user-friendly and intuitive. With a simplified design, executing traders is made easier. The platform is equipped with advanced indicators and one-click trading-enabled charts.

TradeHub has a mobile app version that can be downloaded on Android and iOS devices. Its web-based version includes 13 chart types and more than 170 studies.

Ayondo’s most salient feature, though, is its social trading platform. One of its best functionalities is its ability to track the trader’s performance against equity markets. It is an excellent tool for assessing your potential return over a specified period.

The broker also provides access to educational materials. You can find webinars, training videos, and other manuals. The broker also has a TV spot on an online UK channel.

Bottom Line

Overall, Ayondo is a considerable broker, especially among beginning traders as it provides a user-friendly platform, low minimum account opening amount, and sufficient educational resources.

Though it has a good social trading platform, it is also flawed as it does not cover all jurisdictions to accurately determine the top traders to follow.